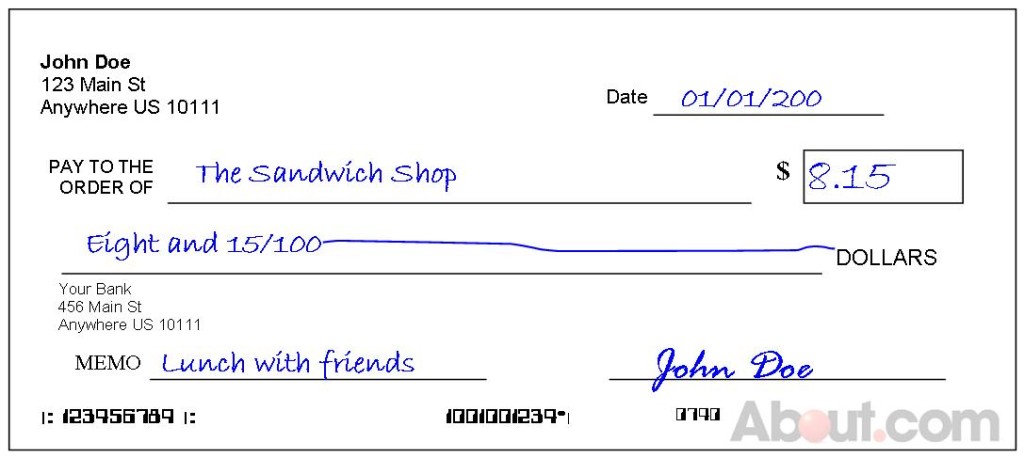

This question comes up from time to time and with the tax deadline approaching, I thought I would post a link with a great step by step tutorial. Click on the image of a check below to go to the tutorial on About.com.

Remember: Use pen and don’t leave extra blank space where someone can make changes.

If you don’t have a checking account and need to make a payment by check, you have two other options: money order or cashier’s check (bank check.) Money orders are available for purchase at your bank, the post office or the customer service desk of some retail stores (CVS, Safeway, WalMart.) You will be charged a small fee, $1.50-$5. Money orders need to be paid for with cash (not credit cards.) You will fill out the money order similarly to a check and keep your receipt portion for your records.

If you are paying your taxes:

- Make check or money order payable to “United States Treasury.”

- Write this info somewhere on the check:

- Your full name

- Your address and phone number

- Your Social Security Number

- 2015 Form 1040 NR-EZ

- Mail your tax forms (keep copies for your records) and payment to:

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201–1303

U.S.A.