Au Pair in America staff, including its community counselors, are not qualified to provide any official tax information. We recommend that you use H & R Block Expat Tax Services or another professional if you have any specific questions regarding U.S. taxes or need help to file your taxes. Below are some resources and general information.

Where to Get Started

- Au Pair in America has a Tax Information for Au Pairs page that explains the basics of how taxes work in the U.S.

- You can view an Instructional Tax Video in your au pair portal. Once you are logged into your au pair portal → go to “Resources” tab → “In the US” → click “Instructional Tax Video for Guidance”

- April 18, 2022, is the deadline to submit your 2021 tax forms and payment. Doing so after that deadline can lead to extra fees and interest charges.

- From the H&R Block Expat Tax Service: “U.S. law requires au pairs who earn more than the filing threshold in stipends during a calendar year to file a U.S. federal tax return. Under the new tax law, the filing threshold is currently $5. Depending on the state in which you earned the income, you may also be subject to state tax filing. If you don’t file, you risk incurring costly interest and penalties, and it may complicate obtaining a U.S. visa in the future.”

If You Want to Get Your Taxes Professionally Done

Au Pair in America has partnered with H & R Block Expat Tax Services which has set up an easy, affordable, and virtual option for au pairs to assist with tax filing. The promotional fee is $50 through February 28th, which includes Federal and State (if applicable) filing. Starting on March 1st the fee increases to $99.

If You Plan to Do Your Own Taxes

- Even if you are planning to prepare your own taxes, I recommend you check out the information on the H&R Block Expat Tax Service page. Scroll down the page and see the answers to lots of common questions au pairs have about taxes.

- If you are planning to prepare your taxes on your own (or with help from your host parents) you can get links to the tax forms HERE.

- If you plan to file your taxes by mail, here are some things you will need to know:

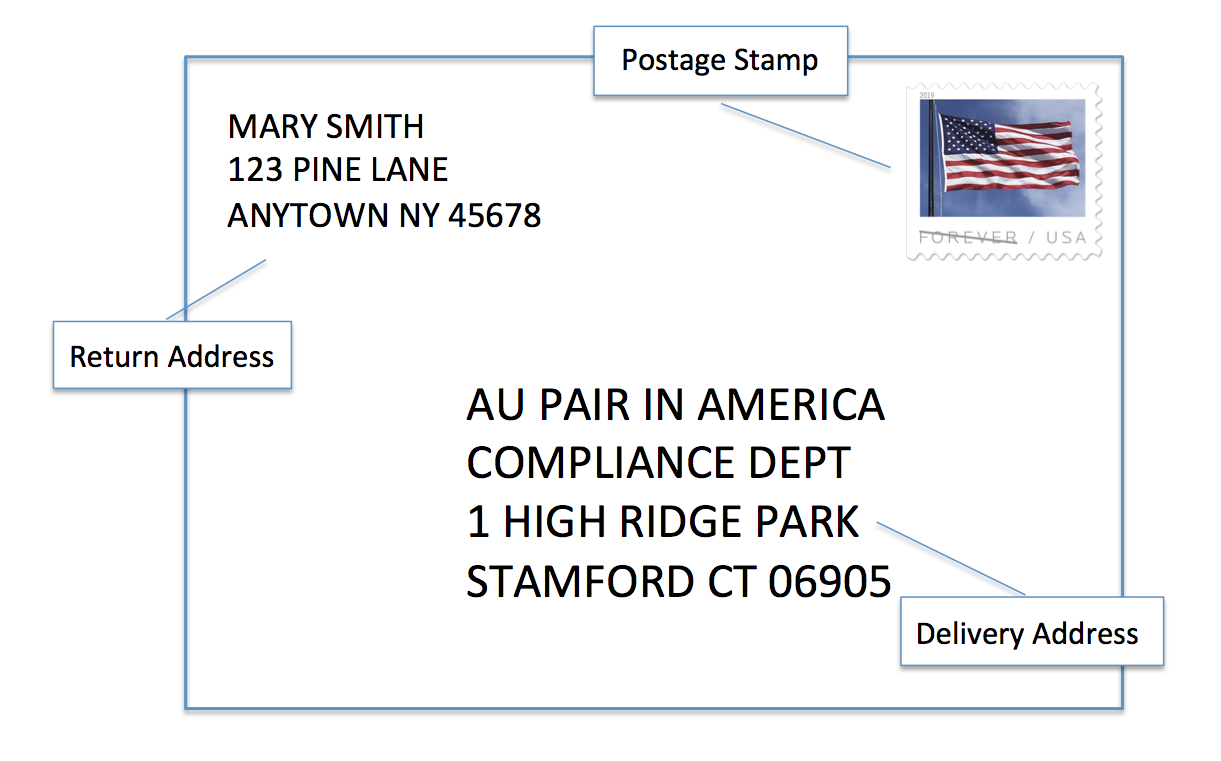

- How to Address an Envelope in the U.S.

- How to Fill Out a Money Order (may be purchased at a bank, post office or CVS)

- Some other important details:

- Include your full name and Social Security Number on your tax forms and your payment (check or money order).

- Make copies of all of the papers you mail to the IRS (your forms and payment) and keep those for your records. (This is very important in case you receive letters from the IRS about your taxes in the future.)

Image: 401(K) 2012